Businesses can change though, and we think it would make sense to see what analysts are forecasting for the company. Without at least some growth in earnings per share over time, the dividend will eventually come under pressure either from competition or inflation. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company.

This looks like it could be a good dividend stock going forward, but we would note that the payout ratio has been at higher levels in the past so it could happen again.Ĭompanies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. The earnings coverage is acceptable for now, but with earnings on the decline we would definitely keep an eye on the payout ratio.

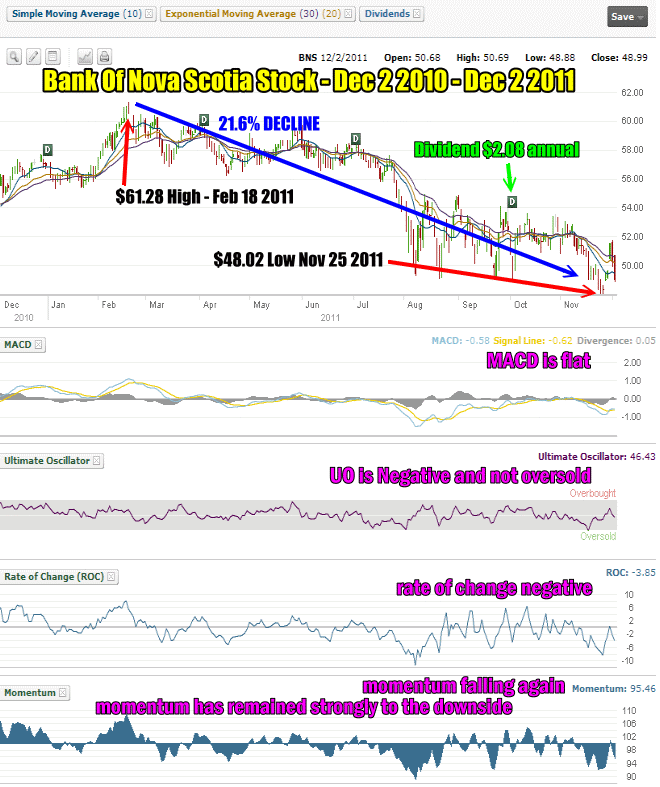

Overall, this is a reasonable dividend, and it being raised is an added bonus. Unfortunately, Bank of Nova Scotia's earnings per share has been essentially flat over the past five years, which means the dividend may not be increased each year. However, initial appearances might be deceiving. The company's investors will be pleased to have been receiving dividend income for some time. The Dividend's Growth Prospects Are Limited The dividend has been growing very nicely for a number of years, and has given its shareholders some nice income in their portfolios. This implies that the company grew its distributions at a yearly rate of about 6.4% over that duration.

Since 2013, the annual payment back then was CA$2.28, compared to the most recent full-year payment of CA$4.24. Historic-dividend Bank of Nova Scotia Has A Solid Track RecordĮven over a long history of paying dividends, the company's distributions have been remarkably stable.

0 kommentar(er)

0 kommentar(er)